If you are looking for urgent and fast money loans in Nevada, then you have found the ideal postwhere you can find extensive information, which you can use as a guide on the most viable options, and the alternatives to which you can resort in the absence of precautions.

In any case, always remember that when it comes to personal loans you have to try to carry out a prior review of all the documentation that they will requestas well as the amounts that will be released to you together with the rates that you will have to pay, until you select the one that suits you best and adapts to your payment possibilities.

5 ways to get urgent and fast money loans in Nevada instantly online

In case you want to apply for a personal loan, you should know that you need a series of precautions that you must record before the platform as they are:

- Personal informationwhere you can fully identify yourself.

- Address datayou must indicate exactly the place where you reside, as well as attach documentation showing that you live in that place, be it address letters or basic service invoices that are in your name.

- be of legal agewhich in the case of the State of Nevada, this begins at age 18.

- You must have identification documents, in fact, If you want to apply to this online personal loan methodology, you must have an ITIN and a social security number.

The five best options we have for you, to request a personal loan online quickly and safely is:

- Best Egg

- Discover Bank

- Marcus

- Upgrade

- Wells Fargo

Alternatives to look for a quick loan without a credit bureau in Nevada

In such case, that you do not have a good credit history, or that you do not have a credit bureau, then you can opt for other options that are not as complex in terms of requirements, such as:

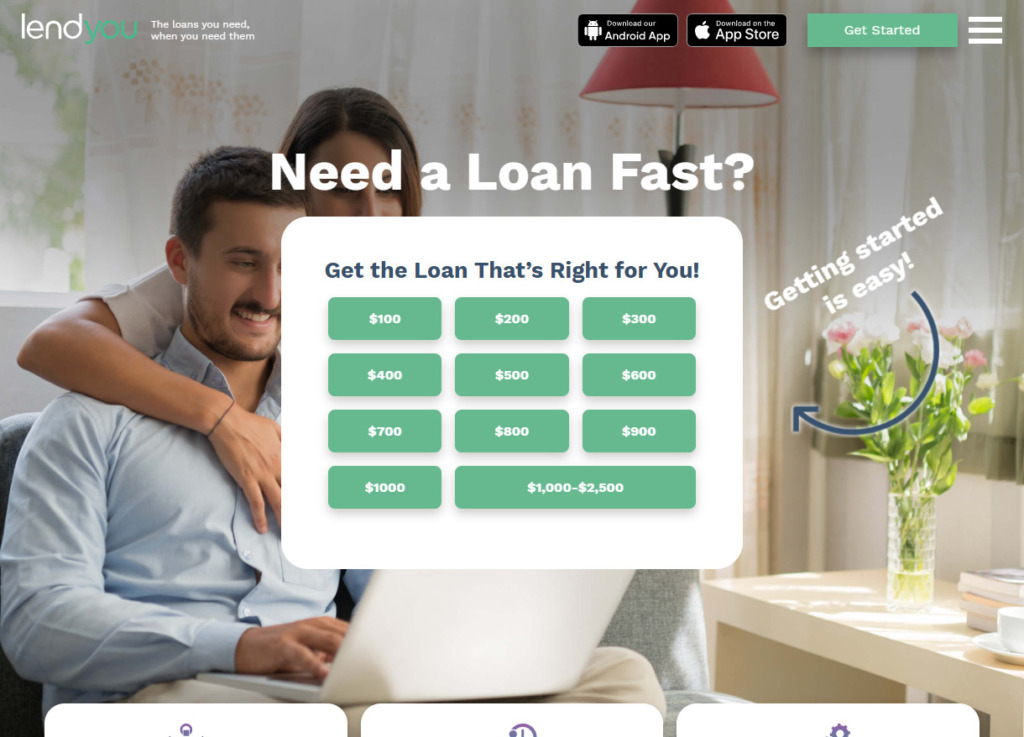

- LendYou

- Bad Credit Loans

- LoanSolo

- MaximusMoney

- greenlightcash

These are themselves online platforms, where you can find lenders willing to give you the amount of money, in exchange for commitments that you assume, such as the consolidation of guarantees or the constitution of guarantees.

In any case, you should know that most lenders request the same papers that are required of you by banks, such as your personal data, documents stating your address and your credit history.

How to borrow money without papers in Nevada?

In the event that you want a loan and you do not have all the paperwork, there are some alternatives in the case of the State of Nevada that you can resort to, such as:

- Secured loans, in this case, we are talking about personal loans that are granted under the credit modalitywhere people grant one or another asset as collateral in order to establish security over their own loan, that is, they deliver an asset, to guarantee its subsequent payment.

- There is a type of loan in Nevada for the cancellation of debts that are granted in the event that people have a pending account and must cover the expenses that come from them.

- It is a rather special conformation of a loan, what it pursues is the gathering of all your debtsto then proceed to pay them, with regard to the subsequent payment of the loan, this is reduced to low installments and with interest rates well below normal.

What are the interests of urgent and fast money loans in Nevada?

As for the interest on loans in Nevada, we are going to provide you with a reference to them:

- Best Egg, has an interest rate that can range between 5% and 36%.

- Discover Bank, places at your disposal an interest rate that can be between 6% and 26%.

- Marcus, presents quite competitive interest rates that are between 7% and 20%.

- Upgrade, this has an interest rate that is between 6% and 36%.

- Well Fargo presents rates between 6% and 22%.

You should consider that the interest rates will vary from the amount requested, as well as the destination that you are going to give the funds.

How to get a car title loan?

The way to proceed to get these money loans for car title, resides in:

- Locate the entity or person to whom you want to request the loan.

- You deliver the required documents along with the title of the car.

- Remember that in said property title, the name of the lender will be included, making the caveat that it is a guarantee modality.

Borrow money with the mortgage guarantee

On the contrary, If you want to request the loan based on the mortgage, you have to go to a bank. These are the only ones that have the due procedure and the link with the legal institutions to form them.

As you know, this is a fairly rigorous process, and also requires the delivery of the ownership document to the bank, the money released is proportional to the value of the asset, and the terms to pay for it are quite long.

3 Ways to get a money loan without ITIN number

As we indicate, there are alternatives to constitute personal loans, among which unsecured loans stand outloans secured with assets but of low value and loans that are directed to the payment of debts.

And it is that if you should know something, it is that in Nevada, there are very few regulations, which is why applying for loans is one of the easiest activities to carry out without so much paperwork.

Urgent and fast money loans in New Mexico Urgent and fast money loans in Miami