The EIP Card refers to a prepaid debit card of the VISA brand, which is sponsored by the Treasury that provides a safe and very convenient way for customers or beneficiaries, who will receive their economic impact payments without having to go to a bank or credit union to cash a check.

This card is issued by the government, who mails the money on a prepaid VISA debit card issued by Meta Bank. Therefore, it is a very feasible option to receive financial aid.

EIP Card, All About How the Stimulus Debit Card Works

The EIP Card is an Economic Impact Payment card provided to United States residents who are eligible for such a benefit.. This prepaid debit card is used to distribute stimulus payments, which allow people to make purchases, withdraw cash through network ATMs, and transfer funds to their personal bank account free of charge.

How do you use your EIP card? – Steps to follow

When you receive the EIP card in the mail, you are being sent the money that is due to you under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.. Therefore, through this card you can make use of the benefit granted by the government. But you must first activate it over the phone before you can use it. Once active, your money is safe and secure on the card.

To use this card it is important that you consider the following steps, in order to activate the card correctly and avoid blocking it. Within which we find:

1.- Visit our Help Center

2.- Activate your Card

3.- Read the Cardholder Agreement, the Fee Schedule and review the Transaction Limits.

4.- Activate your Card account, establish your 4-digit PIN and obtain your balance by calling 1.800.240.8100

5.- Sign the back of your Card

6.- Keep your Card number in a safe place

7.- Use your Card

8.- Buy anywhere debit cards are accepted, such as stores, online or by phone, this includes paying bills

9.- Get cash back at the register with PIN debit purchases at participating merchants

10.- Get cash without surcharge at any network ATM: find one with the ATM locator

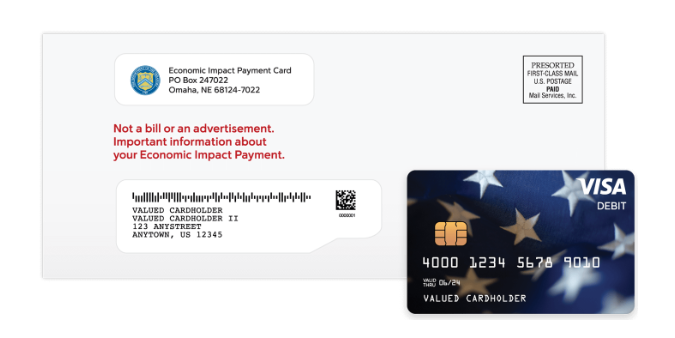

What will my EIP card look like when it arrives in the mail?

As noted above, this card will arrive in the mail based on the address on your last tax return.and will be delivered in a white envelope that will have the seal of the United States Department of the Treasury. Said card will have the name of Visa on the front and the issuing bank, MetaBank NA, on the back.

You will also have information included with the EIP card explaining that it refers to your Economic Impact Payment. Similarly, an “Economic Impact Payment Card” return address will be found.

It should be noted that if you have moved, you must inform the IRS and the USPS about your new address, it is also important to note that this card expires after three years.

How much stimulus check money can be loaded onto an EIP card at one time?

Getting your stimulus payment using an EIP card doesn’t change anything from the amount you would receive, it’s just a different format for the same payment. The amount of money allocated for your third stimulus payment depends on your AGI, or adjusted gross income, from your tax returns, along with your marital status, and also takes into account how many dependents you have.

As for the amount, we found that the maximum amount any individual tax filer could receive is $1,400. However, it should be noted that this third check is “directed”, which could imply an increase in income for your family, or a reduction.

So find out who counts as a dependent on your taxes, how old a dependent must be to receive a separate stimulus payment, and stimulus check status for seniors, people on SSDI, US citizens abroad and people living in the United States.

What can I do if my EIP card is lost or damaged?

In the event that my EIP card has been lost or is badly damaged, a free replacement can be requested through MetaBank Customer Service . The replacement fee will not apply the first time. In addition, you do not need to know your card number in order to request a replacement. Just call 800-240-8100 and choose the second option from the main menu, according to the IRS website.