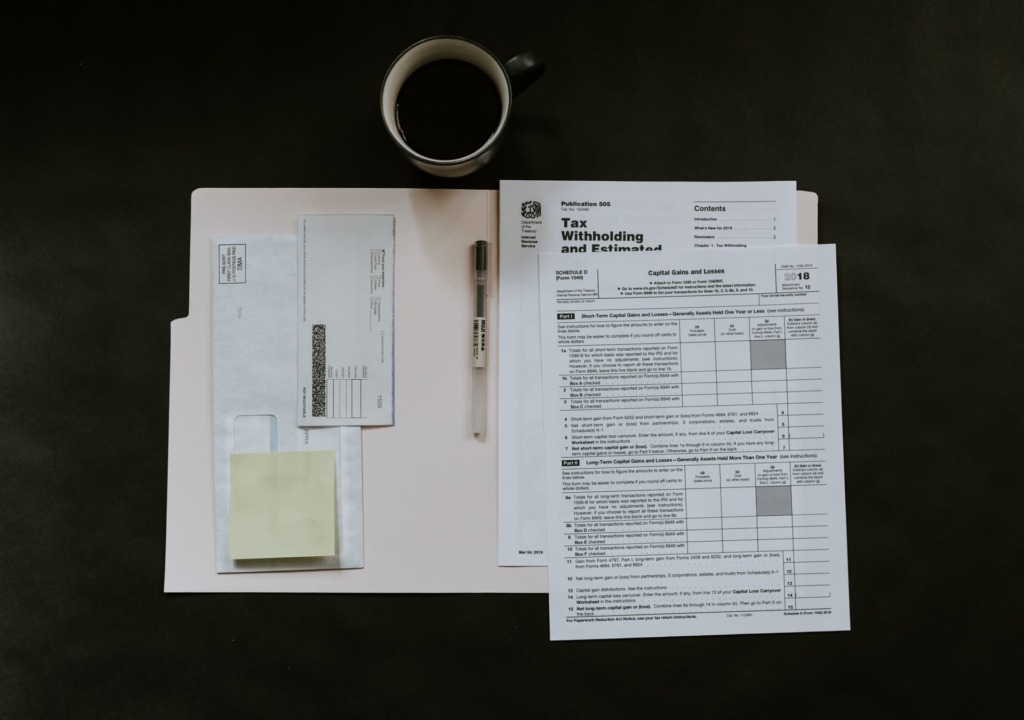

Forms 1099 and W-2 correspond to two formats applied by the Internal Revenue Service. It is used to establish the withholdings, accruals, salaries or payments made to both self-employed workers and dependents. See what is the difference between the 1099 and W-2 forms.

What does this mean? That these forms are highly relevant for those who are hired under any of the two modalities indicated above. Also for the employer who must file their tax return before the IRS.

What is the 1099 form?

First of all you have to know that This form is of an informative nature, which must be filled out by the employer or employer. Due to the withholdings and payments made to an independent worker.

In other words, this is a tax form (because in this only content of purely fiscal and financial importance is declared). This applies in the case of contractors.

What are the most important features of the 1099 form?

This format is distinguished by:

- This is a form filled out by the employer or employer (by this name it is commonly known in the USA). Due to the hiring of independent workers, to provide their services in your company.

- Thus, it declares in the document the payments made to later send it to the self-employed workerso that with it, make your declaration before the IRS.

- The concepts that can be registered in a 1099 form are different, such as royalties paid by an employer to the contractor for their workthe different drafts that are made to your account for your services and the profits that you may have received for the work.

- As a rule this form applies when the dependent worker has earned more than 600 dollars in a yearHowever, if the amount is lower, in any case, it is up to the employer whether or not to send said format.

What is the W-2 form?

It is a tax declaration document that the employer fills out for the salary received by a worker.

It serves before the respective accruals that are made in the same, by way of withholdings that correspond to social obligations.

What are the main features of the W-2?

This form is distinguished by:

- It is filled out by the employer to indicate in it the salary earned by each worker and the aliquots that are withheld for the tax return.

- Among the withholdings that this format handles are those that are made to the worker’s salary for health insurancesocial protection and other perceptions due to their health or protection in case of work accidents and layoffs.

What is the difference between the 1099 and W-2 forms?

- The 1099 form applies to independent people who offer their services without being employees, while the W-2 form corresponds to all those who are hired by a company and are part of a payroll.

- The 1099 form must be filled before February 1 of each year, while the W-2 form is part of a company and must be delivered with its final economic turnaround, which is done before January 31 of each year.

- In the case of a single worker 1099 tax forms are easier and faster to complete due to accurate information what do you require.

If I am sent a gift from abroad, do I have to pay taxes to the IRS? How Can I Get Help Paying Rent? Where to order it?