One of the most useful financial instruments, without a doubt, are credit cards. This is because by obtaining them, you can count on a large amount of economic resources to carry out commercial operations more easily. In the United States, there are several options for obtaining interest-free credit cards. In this article, we will explain what they are and how they work.

It should be mentioned that in most cases, credit cards can be used without paying interest, for a limited time, usually approximately twelve months.

What are the 10 best interest-free credit cards?

Currently, there are many banks around the world that have issued this type of credit card. Nextwe present a brief list of the 10 best options, in terms of this financial resource, which you can use without paying interest.

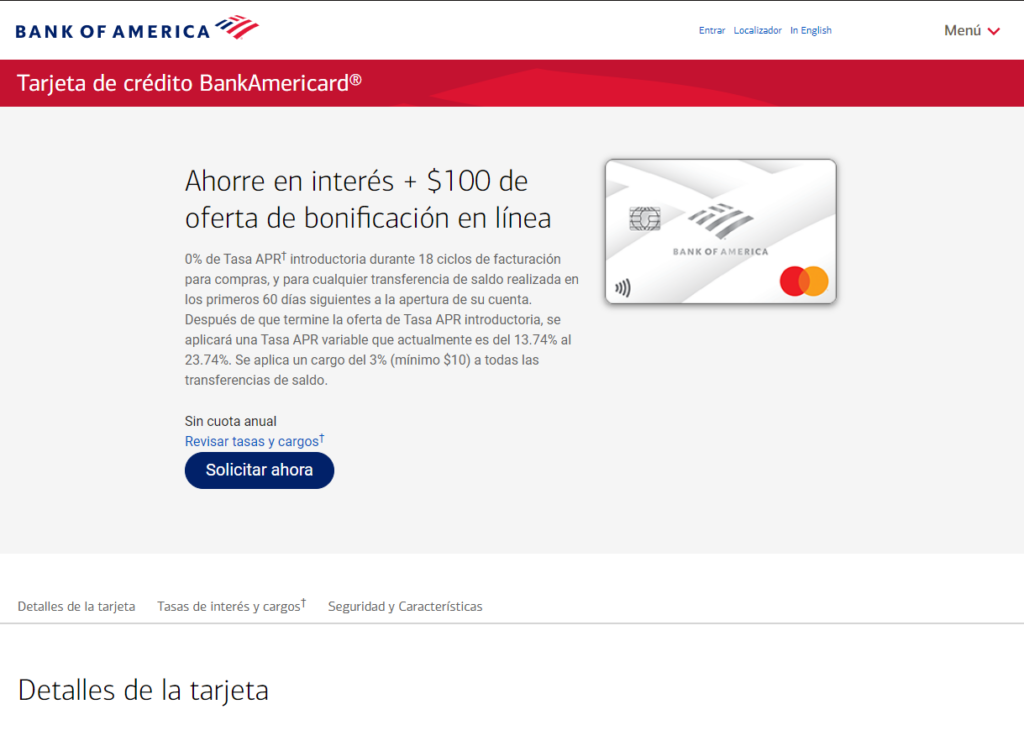

1- Bank American

By obtaining this credit card, you can enjoy great benefits. One of them has to do with the fact that no annual fee should be paid. In addition to this, when receiving money from other bank accounts, the issuing bank of this card does not charge any type of commission.

2. American Express Cash Magnet

This card is one of the best known in the world, due to the advantages it offers to those who use it.. One of the benefits it provides is a bonus that can be as much as $150 after spending the first $1000 on purchases. Plus, for every purchase with this credit card, you automatically receive a 1.5% cashback.

3. Discover Card

To obtain this credit card, no fee must be paid. Also, in some cases, you can receive rebates of up to 5%. Among the establishments where you can enjoy this benefit are restaurants, express stations, among other types of stores associated with this bank.

4. Chase Freedom Unlimited

This credit card has gained great popularity in recent years, due to its many benefits.. One of them is the reimbursement received for each purchase, during the first year of use, which is usually 3%. To acquire this card, you must not cancel any type of fee.

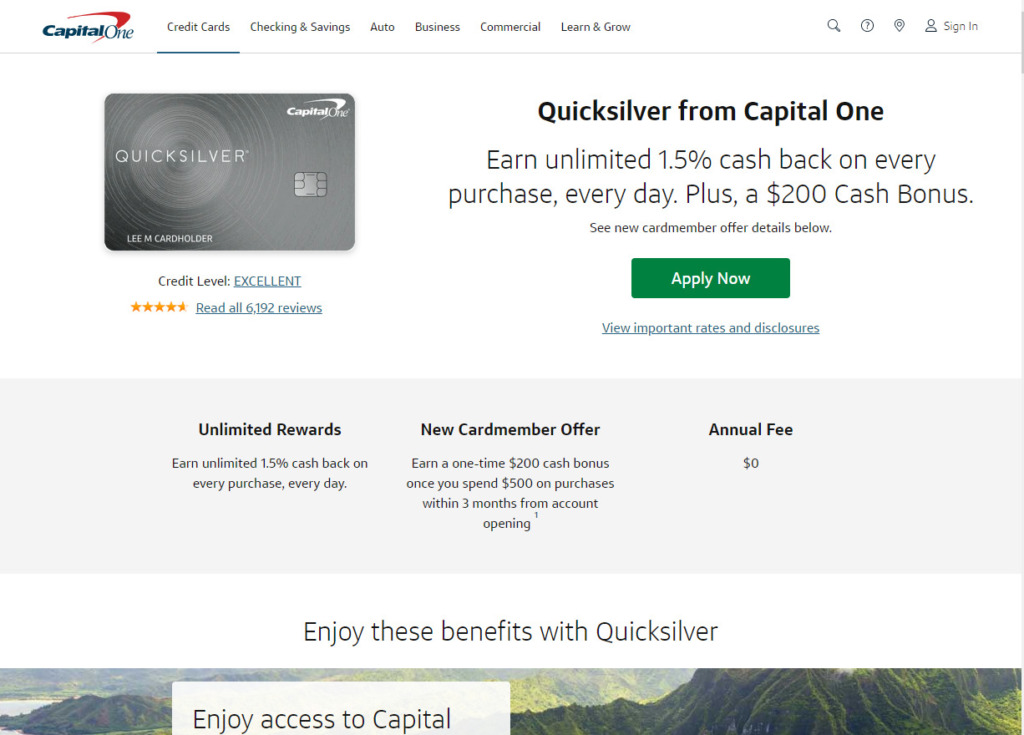

5. Capital One Quicksilver Cash Rewards

Credit cards issued by Capital One, offer their customers bonuses of $150, spending only $500 during the first three months of use.. The period of use without interest is 12 months. During said period of time, the holder obtains a 1.5% refund on absolutely all purchases he makes.

6. Citi Simplicity

One of the most outstanding features of this credit card is that no additional commissions are charged for late payments.. In addition to this, no annual fee is requested. When making transfers or receiving them, the card issuing bank will not add any commission.

7. Bank of America Cash Rewards

Bank of America is one of the most famous banking institutions in the worldthanks to the efficiency of its processes, which is why all its products, including its credit cards, are praised for their excellent quality.

The bonus offered by this bank to its cardholders is $200, when spending $1,000. Cash rebates are 2% for the first twelve months. It should be noted that when you buy gasoline, you get an even higher rebate, which is typically around 3%.

8. Wells Fargo Platinum

Wells Fargo is quite recognized for the security they provide to their clients for any process. As for its credit cards, called ”Wells Fargo Platinum”, the entity offers protection with respect to unauthorized purchases, which are notified by the account holder.

Added to this, by having this credit card, you automatically receive cell phone protection insurance, which is usually approximately $600.

9. Capital One Savor One Cash Rewards

Refunds received when using this card depend on where the purchase is made. When buying groceries, you get 2%, while in entertainment venues you can get even 3%. On the other hand, when making any type of purchase, which does not fall into the aforementioned categories, a 1% refund is received.

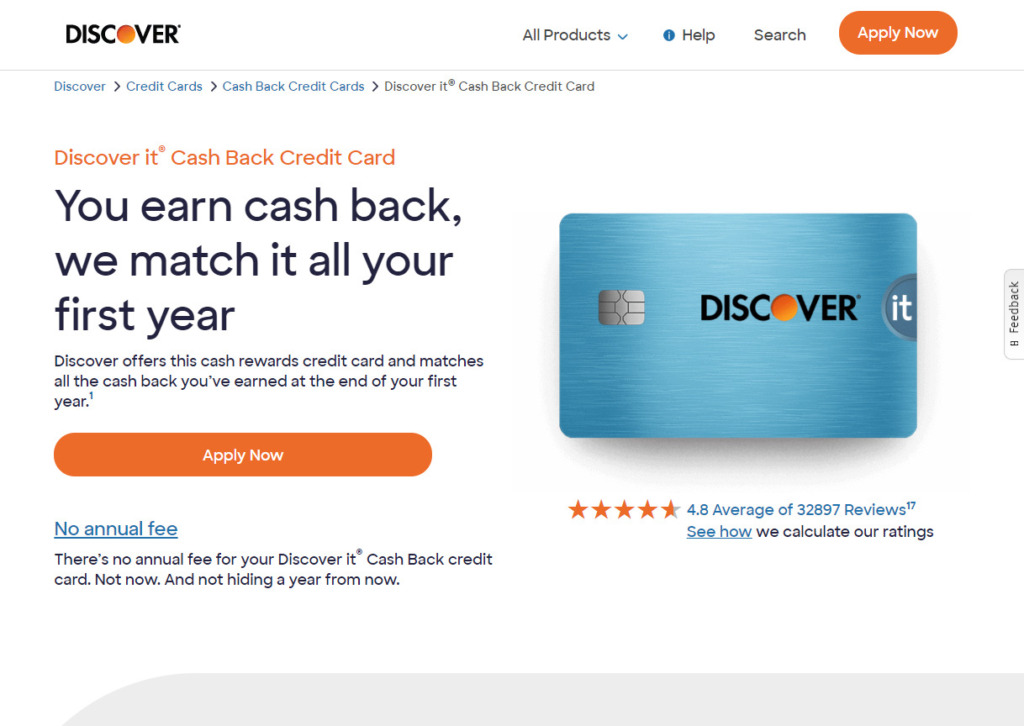

10. Discover It Cash Back Credit Card

Upon receipt of this card, Discover offers an introductory period, without interest. Plus, you get 5% cash back when you make purchases at restaurants and gas stations.

When purchasing items through the Amazon platform, this refund percentage is also received. When using the credit card to make any other purchase, the 1% return is received.

How do Bitcoin debit and credit cards work? The 8 Easiest Credit Cards to Get in the United States