Having a credit card it is really beneficial, due to the fact that this instrument facilitates various business transactions. Because the requested requirements are not too complicated to apply. If you want to easily obtain one of the 8 easiest credit cards to get in the USA, it is important that you continue reading this post.

What are the 8 easiest credit cards to get in the United States?

There are many options that exist regarding credit cards in the United States. Next, we will share a brief list of those that, according to various opinions, are the 10 easiest to achieve.so that you can choose the one that you consider most convenient and most viable for you.

1.OpenSky Secured Visa

This is one of the best options for anyone who wishes to acquire this banking benefit. This is because is not subject to any type of activation fee. On top of this, the APR interest rate is usually not too high a figure. In general, this percentage is located around 17%.

Another of the great benefits provided by obtaining this credit card has to do with the fact that the credit limit is prescribed by the client, in conjunction with the issuing bank. That is, if you obtain this card and want to have a credit in which the amount is not too high, so as not to cancel so much money in interest, you can make this request without any inconvenience.

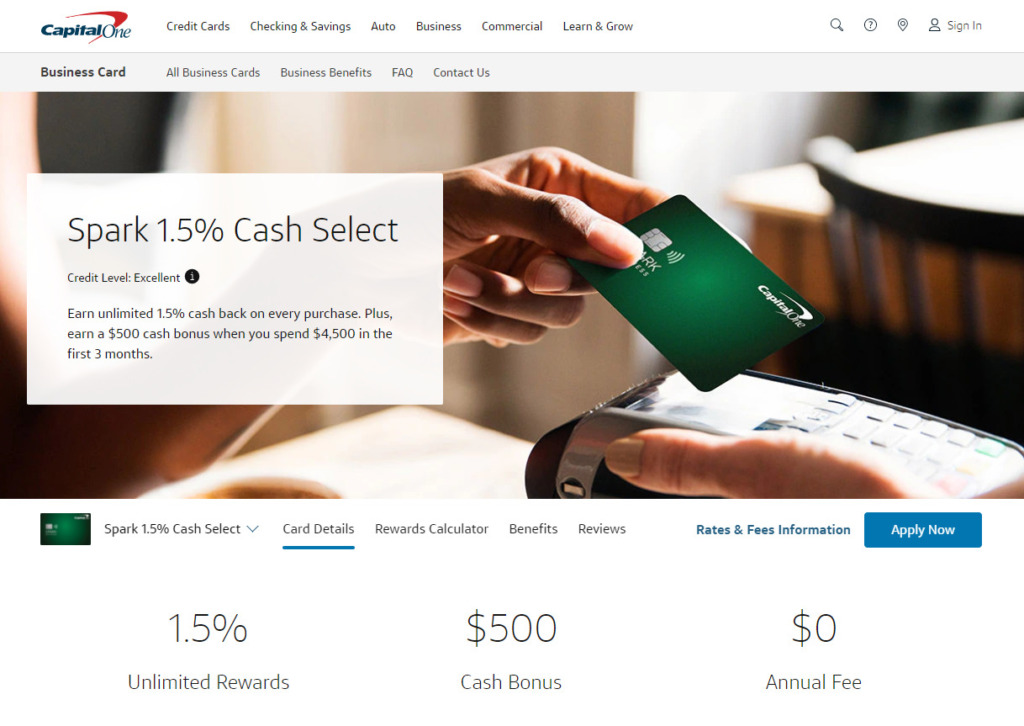

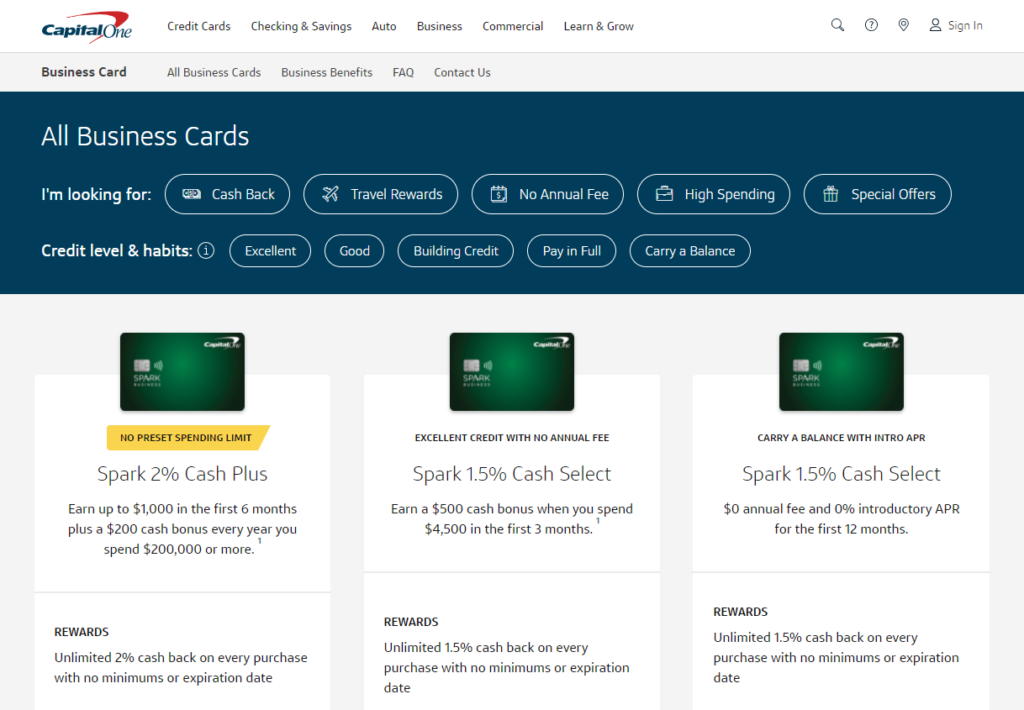

2. Capital One Spark Cash Select for Business

As for this card, several positive aspects should be highlighted. One of them is the percentage of reimbursement for each purchase, which is 1.5%. In addition, no extra annual fee must be paid, only the installments previously indicated in the contract must be paid.

Another of the benefits provided by having this card specifically is obtaining $200 in cash. This bonus is earned by making $3,000 in purchaseswithin a period of time that covers the first three months of opening the bank account.

The initial fees that must be paid are usually not too expensive. Generally, these are priced at approximately $10.

3. OpenSky Capital One Platinum

Another of the options that are viable and beneficial in terms of credit cards, without a doubt is the so-called ”OpenSky Capital One Platinum”. One of the main advantages of opting for this card is the option to obtain much higher lines of credit, by paying the installments before its due date.

This credit card can be obtained by people who do not have a credit history or who have a low rating, so It is an excellent option for those who have little time in the United States.

4. Capital One Spark Classic for Business

This credit card is quite similar to the one mentioned above, since both belong to the same bank. One of the advantages of requesting this instrument has to do with the fact that Capital One notifies the client of any type of unusual activitywith the aim of detecting possible fraud and thus protecting credit.

Besides, This bank offers the option of requesting employee cardsso that companies can grant them to their workers to carry out any type of commercial expense.

5. Discover It Chrome for Students

For every purchase you make with one of these cards, you will receive a refund that can vary between 1 and 2%. In addition, this credit card does not require any type of annual fee, so it does not represent too many expenses for your personal finances.

Another benefit of Discover It Chrome cards for students is bonus credits for good academic performance, which can be as much as $20.

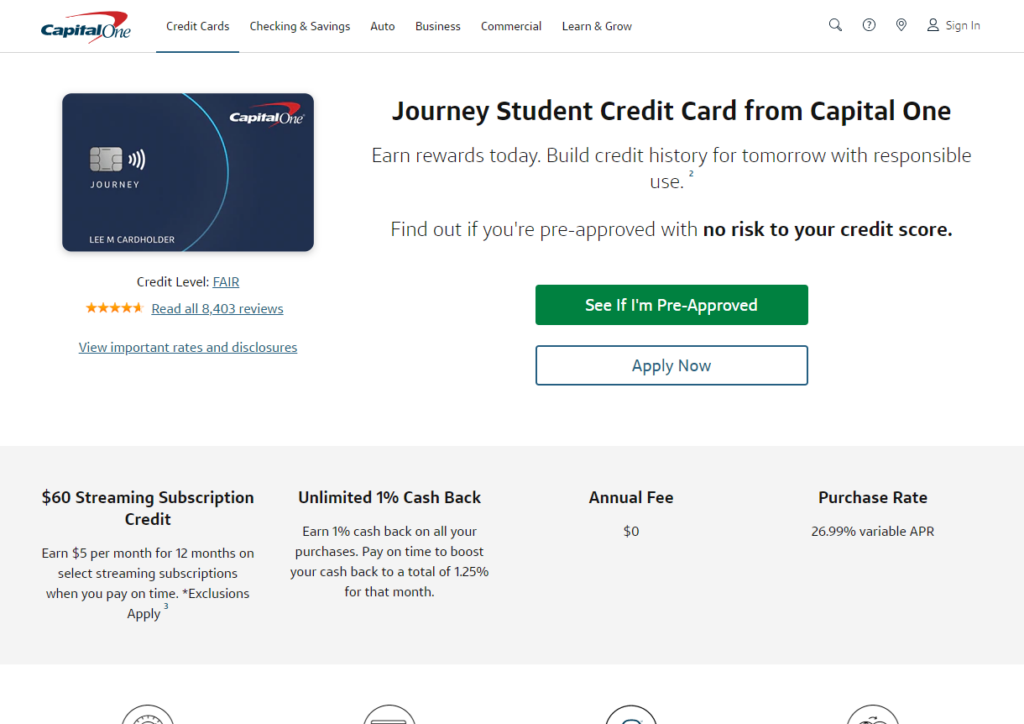

6. Capital One Journey Student Rewards

Obtaining this card is also quite easy, since there are few requirements that must be met for it. Cash back on each purchase is typically 1%. However, by meeting all installment payments, without any delay, this refund can increase to 1.5%.

The APR percentage is 0% for the first year. Added to this, if you manage to spend at least $500 in the first three months, you will receive a bonus of $200.

7. Capital One Spark Miles Select for Business

This card is specially designed for small business owners. Among the bonuses that you can get when using this card, there is one specifically for travel expenses, which is usually approximately $200. The requirement to obtain this benefit is to spend at least $3,000 during the first three months of card use.

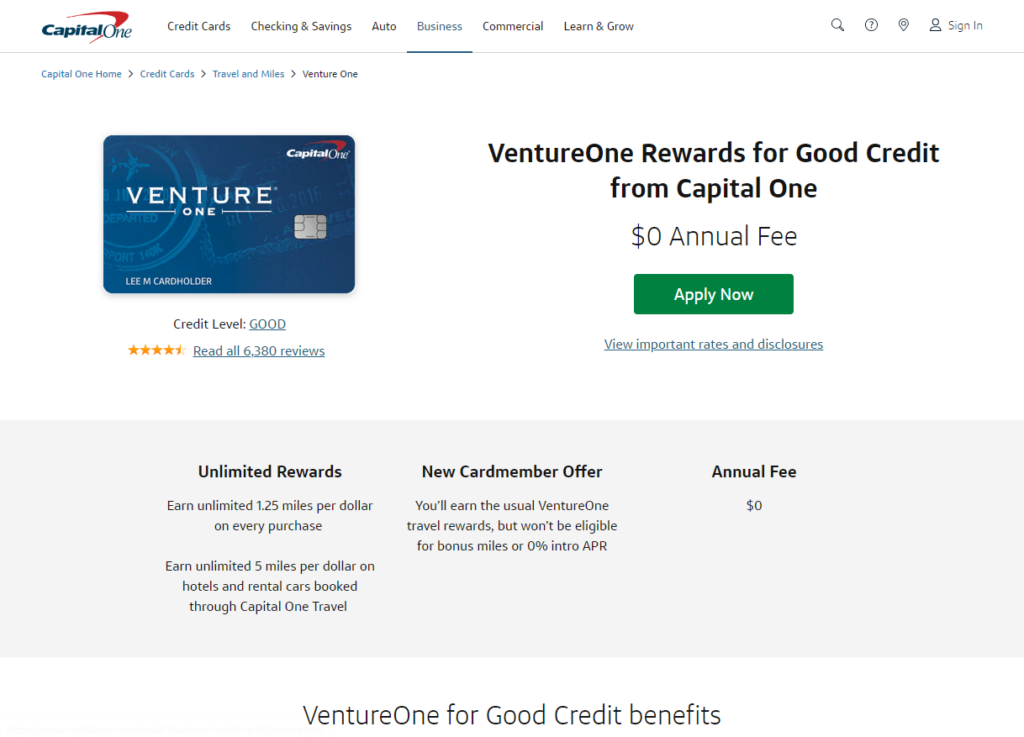

8. Capital One Venture One Rewards

This credit card is also quite profitable. This is because the APR percentage does not have to be canceled for a year. By registering 20,000 miles, the issuing bank can award bonuses that can be up to $200. To acquire this benefit, you must spend $1,000 in the first quarter.

How to pay a credit card with another in the United States? Grace period of a credit card (What is it and for how long)